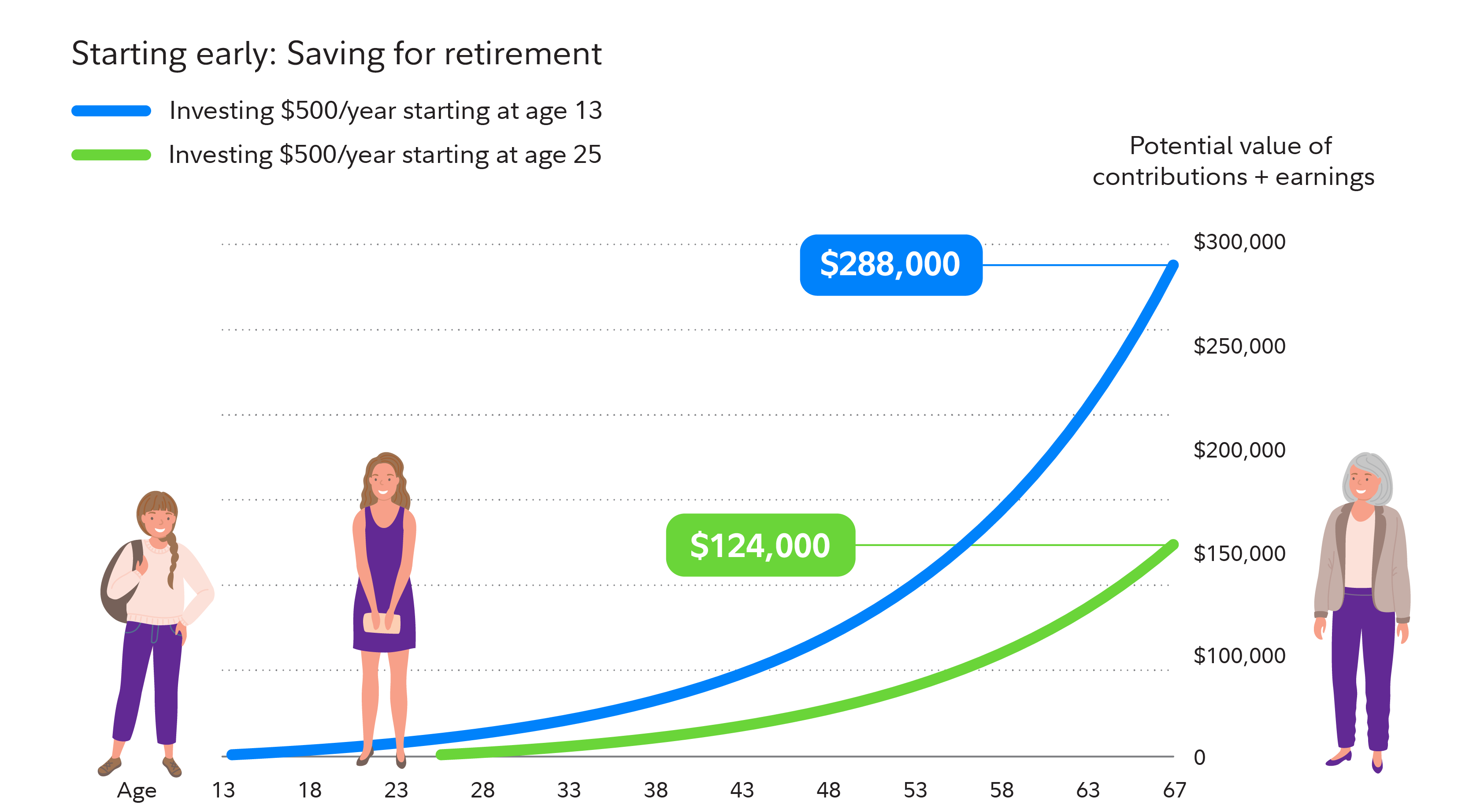

There’s a quiet magic in starting something early—whether it’s learning a skill, planting a tree, or setting aside money for the future. Time, when exploited correctly, has the power to turn small, consistent actions into something far greater than their initial sum. This is especially true when it comes to building wealth. The earlier you begin, the more powerful the results, thanks to the often-overlooked force of compounding.

Imagine two people: Alex and Jamie. Alex starts investing $200 a month at age 25, while Jamie waits until 35 to do the same. Both contribute until they retire at 65, earning an average annual return of 7%. At first glance, the difference seems minor—just a decade’s head start. But by retirement, Alex’s investments grow to around $525,000, while Jamie’s total is closer to $245,000. That extra decade didn’t just add $24,000 more in contributions; it nearly doubled the final amount. This is the power of time in investing.

The Mechanics of Compounding

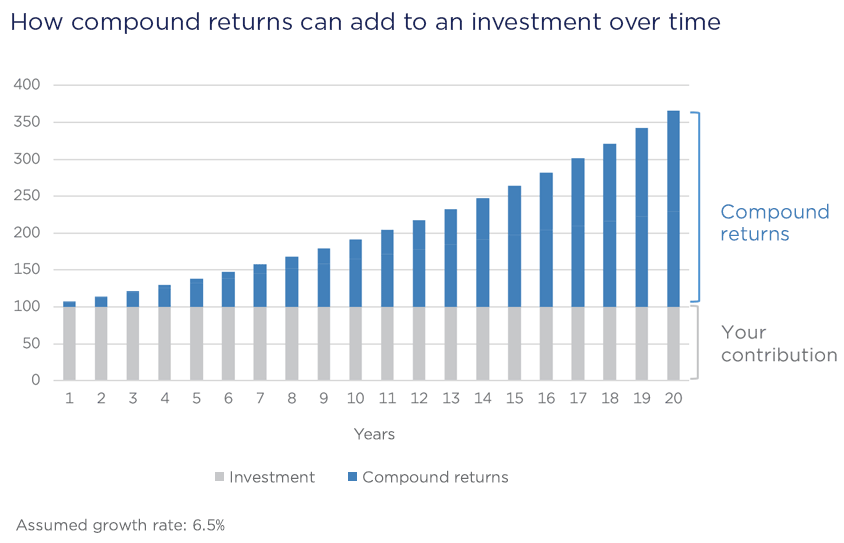

Compounding is often called the “eighth wonder of the world,” and for good reason. In simple terms, it means earning returns not just on your initial investment but also on the accumulated gains over time. Think of it like a snowball rolling downhill—it starts small, but as it gathers momentum, it grows exponentially.

Here’s how it works in practice:

- Year 1: You invest $1,000 and earn a 7% return, making your total $1,070.

- Year 2: You earn 7% on $1,070, not just the original $1,000, bringing your balance to $1,145.

- Repeat over decades: The gains start to accelerate in later years, turning modest contributions into substantial sums.

The outcome? The longer your money stays invested, the more it benefits from this cycle. Even if you can only set aside small amounts early on, the sheer advantage of time can make a staggering difference.

Why Starting Early Reduces Financial Stress

Beyond the numbers, investing early brings psychological benefits. When your wealth grows steadily, you’re less likely to scramble for last-minute solutions later in life. Many people delay investing because retirement feels distant, or they believe they need a large sum to begin. But waiting often leads to stress—playing catch-up requires much larger contributions down the road.

Consider the cost of procrastination:

- At 25: Saving $300/month for 40 years at 7% yields about $719,000.

- At 35: To reach the same amount, you’d need to save nearly $650/month—more than double the initial effort.

The longer you wait, the steeper the climb becomes. Starting early isn’t just about maximizing returns; it’s about giving yourself room to breathe.

Overcoming Common Barriers

Despite the advantages, many hesitate to invest early. Common hurdles include:

“I don’t have enough money.”

You don’t need thousands to start. Many investment platforms allow contributions as low as $10. What matters is consistency.“The market is too risky.”

While markets fluctuate, history shows they trend upward over the long term. Diversifying (spreading investments across stocks, bonds, and other assets) reduces risk.“I’ll start when I earn more.”

By the time income rises, expenses often do too. Small, automated contributions ensure you prioritize investing before lifestyle inflation kicks in.“It’s too complicated.”

Resources like robo-advisors and low-cost index funds simplify the process.

Practical Steps to Begin

Automate your investments.

Set up automatic transfers to a brokerage or retirement account. Treat it like a non-negotiable bill.Take advantage of employer plans.

If your job offers a 401(k) match, contribute enough to get the full match—it’s essentially free money.Focus on low-cost index funds.

These funds track the market’s performance and typically have lower fees than actively managed funds.Increase contributions gradually.

Boost your investment rate whenever you get a raise or pay off debt.

The Ripple Effects of Early Investing

Beyond personal wealth, starting early promotes financial habits that pay off in other ways:

- Better risk tolerance: Younger investors can weather market dips, knowing they have time to recover.

- More flexibility: Accumulated savings open doors—career changes, entrepreneurship, or early retirement.

- Generational impact: Building wealth early allows you to support family or philanthropic causes later.

Final Thoughts

Investing early isn’t about striking it rich overnight. It’s a gradual, disciplined approach that leverages time to work in your favor. The best part? You don’t need to be an expert or have a fortune to begin. You just need to start—preferably today.

Every dollar invested now has decades to grow, and every year delayed makes the path steeper. The choice between stress and security often comes down to a simple question: Why wait when time is your greatest ally?