A credit score is more than just a number—it’s a financial passport that determines your ability to secure loans, rent an apartment, or even land certain jobs. While improving it usually takes months or years, strategic actions can lead to noticeable changes in just 30 days. Whether you’re preparing for a mortgage application or simply want better financial health, here’s how you can boost your score quickly.

Understanding Credit Scores

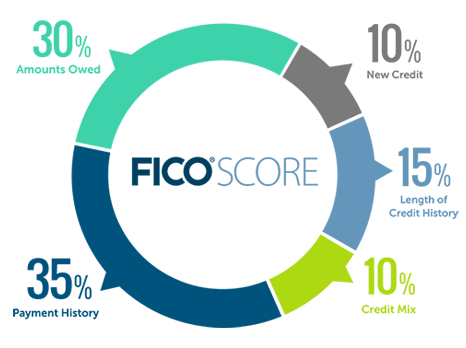

Before making changes, it helps to know what influences your score. The most widely used model, FICO, weighs these factors:

- Payment History (35%): Late or missed payments hurt your score the most.

- Credit Utilization (30%): The percentage of available credit you’re using.

- Credit Age (15%): The average length of your credit accounts.

- Credit Mix (10%): The variety of credit types (loans, credit cards, etc.).

- New Credit (10%): Recent credit inquiries and newly opened accounts.

Understanding the components of a credit score helps in prioritizing actions for improvement.

Step 1: Check Your Credit Reports for Errors

Mistakes on credit reports are more common than you might think. A Federal Trade Commission study found that about 1 in 5 consumers had errors affecting their scores. Obtain free reports from AnnualCreditReport.com and scrutinize them for:

- Incorrect late payment marks

- Accounts you don’t recognize (possible fraud)

- Outdated negative items (older than 7 years)

Dispute errors promptly with the credit bureaus—Equifax, Experian, and TransUnion—to see corrections within 30 days.

Step 2: Lower Your Credit Utilization

Credit utilization (the ratio of your credit card balances to limits) is critical. Experts suggest keeping it below 30%, but aiming for under 10% yields better results. Here’s how:

- Pay down balances early: If you usually pay after the statement date, try paying before it to reduce the reported balance.

- Request a credit limit increase: A higher limit automatically lowers utilization, provided you don’t increase spending.

- Spread out charges: Using multiple cards lightly is better than maxing out one.

Keeping balances low relative to limits is one of the fastest ways to improve a score.

Step 3: Become an Authorized User

If someone with excellent credit adds you as an authorized user on their account, their positive payment history can reflect on your report. This works best with older accounts that have low utilization. Ensure the card issuer reports authorized users to all bureaus—some, like Chase and Amex, do so automatically.

Step 4: Negotiate with Creditors

If late payments are dragging you down, contact creditors directly. Some may agree to:

- Remove late payments from your report if you pay the overdue amount.

- Set up a payment plan to prevent further damage.

This approach, known as “goodwill adjustment,” isn’t guaranteed but can work if you have a solid payment history otherwise.

Step 5: Avoid New Hard Inquiries

Every time you apply for credit, a hard inquiry appears on your report, potentially dropping your score by a few points. In 30 days, it’s best to avoid new applications unless absolutely necessary. If you must apply, do so sparingly—multiple inquiries for the same type of loan (e.g., a mortgage) within a short window often count as one.

Step 6: Use Rent and Utility Payments to Your Advantage

Traditional credit reports often exclude rent and utility payments, but services like Experian Boost and UltraFICO let you add them. These programs factor in on-time payments for:

- Rent (via platforms like RentTrack)

- Utility bills

- Streaming subscriptions

Enrolling can provide an instant lift if you have a thin credit file.

Step 7: Pay Bills on Time—Every Time

Even one late payment can hurt. Set up autopay for minimum payments to avoid misses. If cash flow is tight, prioritize debts that report to credit bureaus first (credit cards, personal loans).

Step 8: Consider a Credit-Builder Loan

If you lack credit history, a credit-builder loan from a credit union or online lender (like Self or Credit Strong) can help. Unlike traditional loans, you pay upfront, and the lender reports payments to bureaus, gradually boosting your score.

Credit-builder loans are structured to help establish or repair credit.

What Not to Do in 30 Days

Some actions can backfire:

- Closing old accounts: This shortens credit history and increases utilization.

- Ignoring collections: Negotiate pay-for-delete agreements to remove negative marks.

- Applying for multiple credit cards: Each application triggers a hard inquiry.

Tracking Your Progress

Use free tools like Credit Karma or your bank’s credit monitoring to track changes. While FICO updates monthly, some lenders report at different times, so improvements may not appear instantly.

Final Thoughts

While no strategy can magically transform a poor score into an excellent one overnight, these steps can set you on the right path. The key is consistency—maintaining good habits beyond 30 days ensures lasting improvement. For deeper insights, the Consumer Financial Protection Bureau offers resources on credit management.

By focusing on high-impact areas—errors, utilization, and payment history—you can make meaningful progress in just a month. The effort pays off when you secure better interest rates and financial opportunities down the line.