Building an emergency fund is one of those financial steps that often gets postponed, yet it remains one of the most critical safety nets you can create for yourself. Life is unpredictable—job losses, medical emergencies, unexpected car repairs, or sudden home maintenance can strike without warning. Without a financial cushion, these situations can spiral into long-term debt or financial instability.

Understanding the Importance of an Emergency Fund

An emergency fund is a designated pool of money set aside for unforeseen expenses. Unlike savings earmarked for vacations or a new gadget, this fund is strictly for crises that require immediate financial attention. The absence of one can force people to rely on high-interest credit cards, loans, or even borrowing from friends and family, which can strain relationships and finances.

According to a Federal Reserve report, nearly 40% of Americans would struggle to cover a $400 emergency expense. This statistic highlights how precarious personal finances can be without a safety net. An emergency fund acts as a buffer, preventing financial shocks from derailing long-term goals like retirement savings or homeownership.

How Much Should You Save in an Emergency Fund?

The ideal size of an emergency fund varies based on personal circumstances, but financial experts generally recommend the following guidelines:

-

Starter Emergency Fund ($1,000 – $2,500)

If you’re just beginning, aim for a small but meaningful amount to cover minor emergencies like a car repair or medical co-pay. This initial step prevents reliance on debt for small crises. -

Full Emergency Fund (3-6 Months of Living Expenses)

Once the initial fund is established, work toward saving enough to cover three to six months’ worth of essential expenses—rent, utilities, groceries, and debt payments. Freelancers, gig workers, or those in unstable industries may want to aim for closer to six to twelve months. -

Extended Emergency Fund (6-12 Months of Expenses)

High-risk professions, single-income households, or those with significant financial obligations (e.g., mortgages, dependents) might benefit from a larger cushion.

Building an emergency fund is a gradual process, but each step provides greater financial security.

Steps to Building an Emergency Fund Efficiently

1. Assess Your Current Financial Situation

Before setting a savings goal, review your monthly income, fixed expenses, and discretionary spending. Tools like Mint or YNAB can help track cash flow and identify areas where you can redirect money toward savings.

2. Start Small and Automate Savings

If saving several months’ worth of expenses feels overwhelming, begin with a smaller target, such as $500 or $1,000. Set up an automatic transfer from your checking to a dedicated high-yield savings account each pay period. Even $20 or $50 per paycheck adds up over time.

3. Cut Non-Essential Spending

Temporarily reduce discretionary expenses—dining out, subscriptions, or impulse purchases—to redirect funds toward your emergency savings. For example, canceling an unused gym membership or switching to a cheaper phone plan can free up extra cash.

4. Increase Income Streams

If cutting expenses isn’t enough, consider side hustles, freelance gigs, or selling unused items. Platforms like Upwork for freelancers or Facebook Marketplace for selling goods can provide quick cash injections.

5. Protect the Fund from Temptation

Keep emergency funds in a separate savings account that isn’t easily accessible for daily spending. A high-yield savings account ensures the money grows modestly while remaining liquid. Avoid investing this money in stocks or other volatile assets—liquidity and stability are key.

Common Mistakes to Avoid

While building an emergency fund seems straightforward, several pitfalls can undermine progress:

- Relying on Credit Cards as a Backup – While convenient, credit cards often come with high interest rates that can worsen financial strain.

- Skipping Regular Contributions – Consistency is crucial; sporadic deposits slow down progress.

- Underestimating Expenses – Base your target on actual living costs, not idealistic projections.

- Using the Fund for Non-Emergencies – A “great deal” on a TV or a last-minute vacation doesn’t qualify as an emergency. Stay disciplined.

An emergency fund provides peace of mind, reducing stress when unexpected costs arise.

When Should You Use Your Emergency Fund?

The purpose of this fund is to cover genuine emergencies—unexpected, urgent, and necessary expenses. Examples include:

- Job Loss – Covers living expenses while searching for new employment.

- Medical Emergencies – Pays for unexpected procedures, prescriptions, or deductibles.

- Urgent Home or Car Repairs – Fixes a leaking roof, broken furnace, or car failure.

- Family Emergencies – Covers travel costs for a sick relative or sudden caregiving needs.

Non-emergencies like planned vacations, holiday shopping, or upgrading electronics should not dip into this fund. If you do use it, prioritize replenishing it as soon as possible.

Rebuilding After an Emergency

If you’ve had to use part or all of your emergency fund, treat rebuilding it with the same urgency as creating it initially. Return to your automatic savings plan, cut unnecessary expenses, and consider additional income sources until the fund is restored.

Final Thoughts

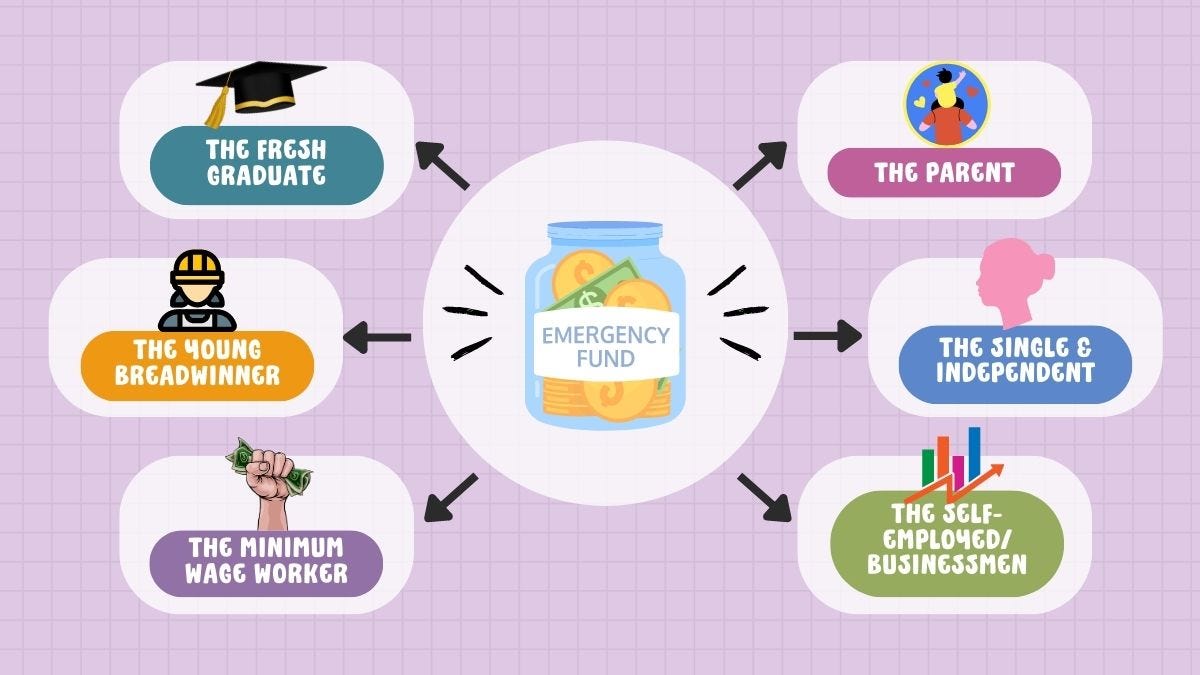

An emergency fund isn’t just about money—it’s about stability, reducing stress, and gaining control over financial uncertainties. The process requires discipline and patience, but the security it provides is invaluable. Whether you’re a freelancer navigating irregular income, a professional preparing for unexpected layoffs, or a family safeguarding against unforeseen events, this financial buffer ensures you’re prepared for life’s uncertainties.

For further reading on financial preparedness, the Consumer Financial Protection Bureau offers additional guidance on managing savings and debt. Start small, stay consistent, and watch your financial resilience grow.