Building multiple income streams is not just a safety net—it’s a way to amplify financial freedom. The internet has democratized earning opportunities, making it possible for anyone with determination to generate revenue from multiple sources. Whether you’re a freelancer, a professional looking for side income, or an entrepreneur expanding your business, there are countless ways to diversify your earnings online.

Understanding the Power of Multiple Income Streams

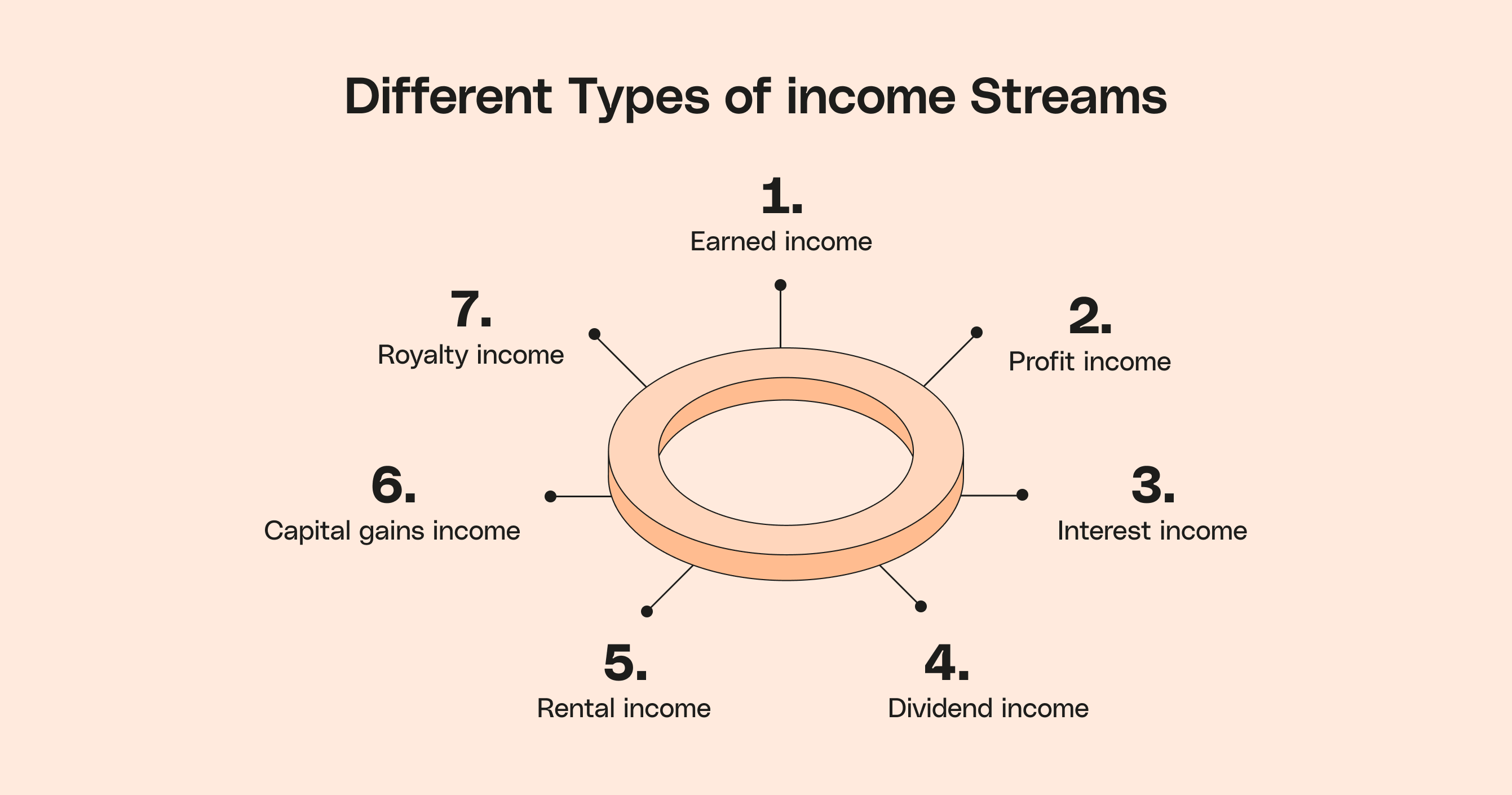

Relying on a single source of income is risky. Economic downturns, job losses, or industry disruptions can destabilize financial health. Multiple income streams provide resilience, flexibility, and the ability to grow wealth faster. According to a study by Forbes, the average millionaire has at least seven income sources.

Creating several revenue streams doesn’t mean working endlessly on unrelated gigs. Instead, it’s about strategically combining complementary income sources that align with your skills, time, and financial goals.

1. Freelancing: Leverage Your Skills for Immediate Earnings

Freelancing is one of the fastest ways to start making money online. Platforms like Upwork, Fiverr, and Toptal connect skilled professionals with clients worldwide.

Popular Freelance Niches:

- Writing & Editing: Blog posts, copywriting, technical writing.

- Graphic Design: Logos, branding, social media content.

- Web Development: WordPress, custom coding, app development.

- Digital Marketing: SEO, paid ads, email marketing.

Freelancing allows you to monetize expertise without long-term commitments. As you gain experience, you can increase rates and attract high-paying clients.

2. E-Commerce: Sell Products Without Needing Inventory

Starting an online store used to require significant investment, but dropshipping and print-on-demand have changed that.

Dropshipping

With platforms like Shopify, you can sell products without handling inventory. Suppliers ship directly to customers, reducing upfront costs. Research trending products using tools like Oberlo or AliExpress.

Print-on-Demand

Websites like Printful and Redbubble let you sell custom-designed T-shirts, mugs, and phone cases. You design, and they handle printing, shipping, and customer service.

3. Content Creation: Monetize Your Passion

If you enjoy creating videos, writing, or speaking, platforms like YouTube, Medium, and podcasting can turn your passion into profit.

YouTube Monetization

Once a channel hits 1,000 subscribers and 4,000 watch hours, you can join the YouTube Partner Program for ad revenue. Other income streams include sponsorships, affiliate marketing, and selling digital products.

Blogging & Medium

Starting a blog with WordPress or publishing on Medium can generate income through ads, memberships, and affiliate links. Focus on high-value niches like finance, health, or technology to increase earnings.

4. Affiliate Marketing: Earn Commissions by Promoting Products

Affiliate marketing involves recommending products and earning a commission on sales. It’s a passive income stream that works well with content creation.

Best Affiliate Programs:

- Amazon Associates – Earn 1-10% on product sales.

- ShareASale – Thousands of brands across various niches.

- CJ Affiliate – High-ticket products with better payouts.

Use SEO and social media to drive traffic to your affiliate links. Honest reviews and tutorials build trust with your audience.

5. Online Courses & Digital Products: Sell Knowledge

If you have expertise in a field, creating an online course or selling digital products can be highly profitable.

Course Platforms:

- Udemy – Host courses on their marketplace.

- Teachable – Build and sell courses from your own website.

- Kajabi – All-in-one platform for courses, coaching, and memberships.

Digital products like eBooks, templates, or stock photos can also generate passive income. Websites like Gumroad make selling digital downloads easy.

6. Investing & Passive Income Streams

Beyond active income, passive investments can create long-term wealth.

Stock Market & Dividends

Platforms like Robinhood or E-Trade allow beginners to invest in stocks. Dividend-paying stocks provide regular payouts.

Real Estate Crowdfunding

Sites like Fundrise let you invest in real estate without buying property directly.

Peer-to-Peer Lending

LendingClub and Prosper enable you to lend money to borrowers and earn interest.

7. Remote Work & Consulting

Remote jobs and consulting provide stable income while maintaining flexibility.

Remote Job Boards:

- We Work Remotely – High-quality remote job listings.

- Remote.co – Curated remote opportunities.

- FlexJobs – Pre-screened remote and flexible jobs.

Consulting leverages your expertise to help businesses solve specific problems. Charge hourly or project-based fees for services like business strategy, marketing, or financial planning.

8. Membership & Subscription Models

Recurring revenue is powerful. Membership sites and subscription services ensure consistent income.

Membership Platforms:

- Patreon – For creators earning from fans.

- MemberPress – WordPress plugin for memberships.

- Substack – Paid newsletters.

Offer exclusive content, coaching, or community access to keep subscribers engaged.

9. App & Software Development

If you have coding skills, creating apps or software can be lucrative.

Low-Code Options:

- Bubble – Build apps without deep coding knowledge.

- Flutter – Develop cross-platform mobile apps.

Monetize through ads, in-app purchases, or subscription models.

10. Social Media Monetization

Social platforms offer various ways to make money beyond brand sponsorships.

Instagram & TikTok Shops

Sell products directly through these platforms.

Facebook Groups & Communities

Charge for exclusive group access or premium content.

Twitter & LinkedIn Monetization

Engaging audiences can lead to paid speaking gigs, consulting, or sponsorships.

Strategies for Managing Multiple Income Streams

While diversification is beneficial, managing multiple streams effectively is crucial.

Tips for Success:

- Automate What You Can – Use tools like Zapier to streamline workflows.

- Prioritize High-Value Streams – Focus more on passive income sources.

- Track Finances Carefully – Tools like QuickBooks help monitor earnings.

- Balance Effort & Reward – Avoid spreading yourself too thin.

Final Thoughts

Building multiple income streams requires effort, but the payoff is financial security and freedom. Start with one or two methods, refine them, then expand. The internet offers endless possibilities—whether through freelancing, e-commerce, content creation, or investing. By combining active and passive income sources, you can create a sustainable financial future.

For further reading, check out The 4-Hour Workweek by Tim Ferriss, a great resource on automating income.

The journey to multiple income streams is unique for everyone. Experiment, learn, and adapt strategies that fit your lifestyle and goals. Over time, you’ll build a diversified income portfolio that offers stability and growth.