When it comes to securing long-term financial growth, the right investment strategies can make all the difference. Whether you’re just starting out, running a small business, or freelancing, understanding how to allocate resources wisely ensures stability and future prosperity. Below, we examine five practical and effective approaches to building wealth over time.

1. Diversify Your Portfolio

One of the oldest yet most reliable principles in investing is diversification. Putting all your money into a single asset class—say, stocks or real estate—can be risky. Instead, spreading investments across different sectors minimizes the impact of a poor-performing asset.

For example, a balanced portfolio might include:

- Stocks (both domestic and international)

- Bonds (government or corporate)

- Real estate (REITs or rental properties)

- Commodities (gold, silver, or oil)

A study by Vanguard found that diversified portfolios historically outperform concentrated ones over long periods.

By having a mix, you protect yourself against market volatility. If stocks dip, bonds or real estate might hold steady, reducing overall losses.

2. Invest in Index Funds or ETFs

For those who don’t have the time or expertise to pick individual stocks, index funds and exchange-traded funds (ETFs) offer a hands-off approach. These funds track a market index—like the S&P 500—and provide broad exposure with low fees.

Why they work:

- Lower costs – Unlike actively managed funds, index funds have minimal expense ratios.

- Consistent returns – Historically, the stock market trends upward, making index funds a solid long-term bet.

- Easy to manage – Once you invest, there’s little need for constant monitoring.

Warren Buffett has famously recommended index funds for most investors, calling them the best option for steady growth.

3. Reinvest Dividends for Compounding Growth

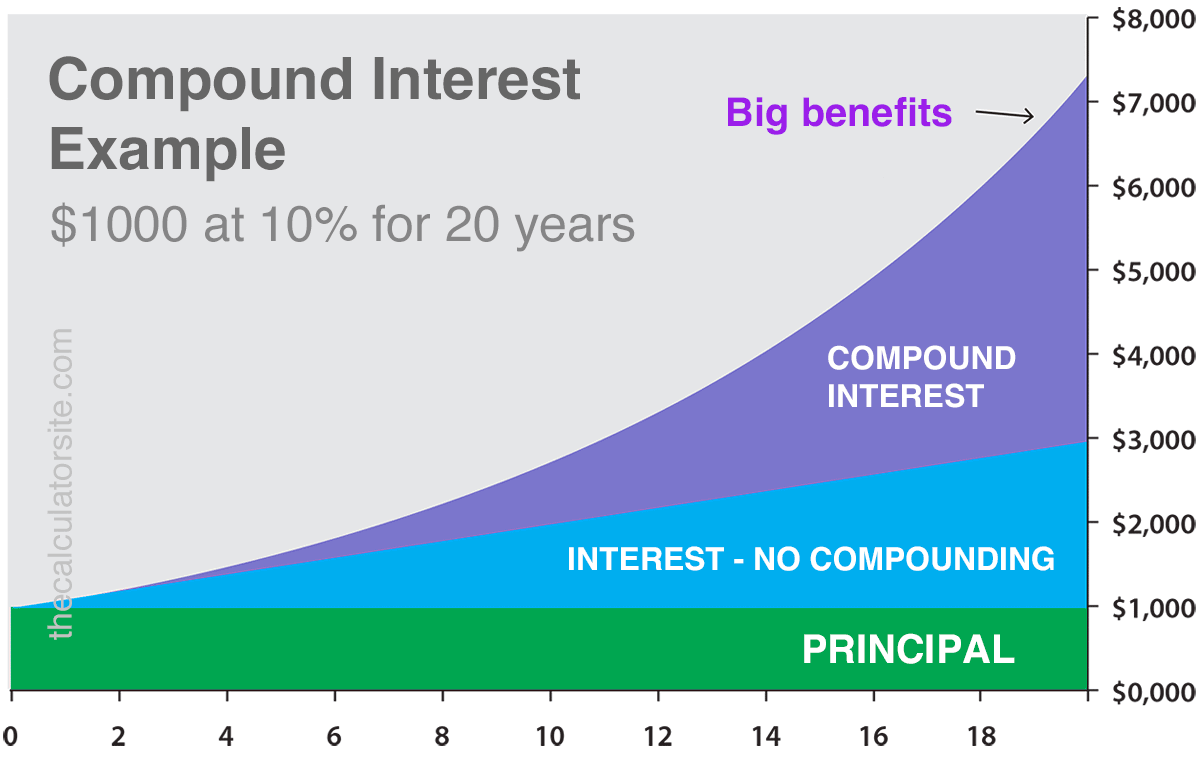

Dividend-paying stocks or funds provide regular income, but reinvesting those dividends can accelerate growth through compounding. This means your earnings generate even more earnings over time.

Example:

If you invest $10,000 in a stock with a 4% annual dividend yield and reinvest those dividends, your investment could grow exponentially. Over 30 years, assuming a 7% average return, that initial $10,000 could become over $76,000 without any additional contributions.

The key is patience—compounding works best when given years (or decades) to grow.

4. Consider Real Estate for Passive Income

Real estate remains one of the most tangible ways to build wealth. Whether through rental properties or Real Estate Investment Trusts (REITs), property investments generate passive income and appreciate over time.

Options for real estate investing:

- Rental properties – Generate monthly cash flow, but require active management.

- REITs – Allow you to invest in real estate without owning physical property.

- Crowdfunding platforms – Sites like Fundrise let you pool money with other investors for real estate projects.

Though real estate has upfront costs, the long-term benefits—such as tax deductions and steady income—make it a smart addition to any portfolio.

5. Automate Your Investments (Dollar-Cost Averaging)

Market timing is tricky—even professionals struggle to predict highs and lows. Instead of trying to outguess the market, automate your investments through dollar-cost averaging (DCA).

How it works:

- Invest a fixed amount (e.g., $500) at regular intervals (monthly, quarterly).

- Buy more shares when prices are low, fewer when prices are high.

- Reduce emotional investing and smooth out market volatility.

Many brokerages, such as Fidelity or Charles Schwab, offer automatic investment plans that make DCA seamless.

Final Thoughts

Long-term financial growth isn’t about quick wins—it’s about consistency, patience, and smart decision-making. By diversifying, embracing index funds, reinvesting dividends, exploring real estate, and automating contributions, you position yourself for sustainable success.

No single strategy works for everyone, so tailor these principles to fit your risk tolerance, goals, and lifestyle. Start small if needed, but start today—the sooner you invest, the more time your money has to grow.

By adopting these strategies, you’ll be better equipped to navigate financial markets and build lasting wealth, one step at a time.